EX-99.1

Published on November 12, 2024

November 12, 2024

Exodus Reports Third Quarter 2024 Results

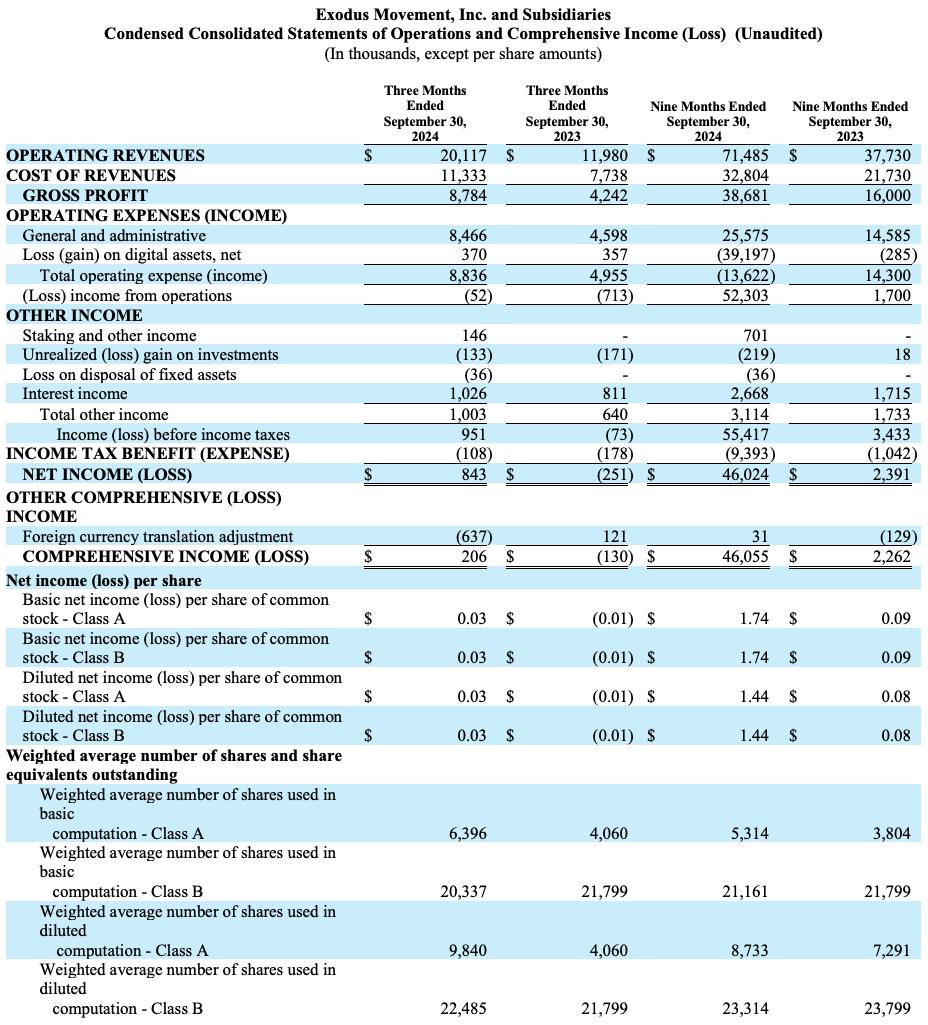

Revenue of $20.1 million, up 68% year-over-year in Q3

Exodus Movement, Inc. (OTCQX: EXOD), (the “Company” or “Exodus”) the leading self-custodial cryptocurrency software platform, today announced its results for the third quarter ended September 30, 2024.

Third Quarter 2024 Financial Highlights (Unaudited)

In USD millions, except percentages |

Q3 2024 |

Q3 2023 |

|

% Change |

Revenue |

$20.1 |

$12.0 |

|

68% |

Cost of Revenues |

11.3 |

7.7 |

|

46% |

Total Operating Expenses1 |

8.8 |

5.0 |

|

78% |

General and administrative |

8.5 |

4.6 |

|

84% |

Loss on digital assets, net1 |

0.4 |

0.4 |

|

- |

Loss from Operations |

(0.1) |

(0.7) |

|

|

Operating Margin |

<-1% |

-6% |

|

|

Net Income (Loss) |

$0.8 |

($0.3) |

|

|

“In the third quarter, we achieved milestones that significantly expanded our partnership strategy and product innovation,” said JP Richardson, CEO and co-founder of Exodus.

“Our new partnership with Ledger and the expansion of our Magic Eden Wallet to mobile devices will enable us to reach new users. We also launched our Passkeys product for developers, making it easier for decentralized applications to onboard their users with a frictionless wallet experience.

1 Includes digital assets marked to market under new GAAP guidelines, specifically ASU 2023-08.

1

By removing the barriers and complexities of owning digital assets, we’re helping the everyday consumer take part in the fast growing digital asset market.”

“In Q3, we delivered both high year-over-year revenue growth and profitability, which demonstrates the strength of our business model as well as the growing adoption of the digital asset market,” said James Gernetzke, CFO of Exodus. “We are excited by the early momentum of our partnership strategy that can help drive efficient user acquisition and with our product innovation that we believe will continue to attract new users and decentralized applications to our platform.”

Third Quarter Operational and Other Financial Highlights

Revenue by category

|

|

% of 2024 |

|

% of 2023 |

Revenue ($ millions) |

Q3 2024 |

Operating Revenue |

Q3 2023 |

Operating Revenue |

Exchange aggregation |

$18.1 |

90.1% |

$11.2 |

93.7% |

Fiat on/off-boarding |

0.9 |

4.2% |

0.6 |

4.8% |

Staking |

0.5 |

2.4% |

0.2 |

1.4% |

Consulting |

0.3 |

1.5% |

- |

- |

Other |

0.3 |

1.8% |

<0.1 |

0.1% |

Operating Revenues |

$20.1 |

100.0% |

$12.0 |

100.0% |

Q3 2024 Webcast

Exodus will host a webcast of its third quarter 2024 fiscal results beginning at 5:00 PM (Eastern Time) on November 12, 2024. To access the webcast, please use this link. It will also be carried on the Company’s website www.exodus.com.

Contact Exodus Customer Support

support@exodus.com

2

Contact Exodus Investor Relations

investors@exodus.com

About Exodus

Exodus is a financial technology leader empowering individuals and businesses with secure, user-friendly crypto software solutions. Since 2015, Exodus has made digital assets accessible to everyone through its multi-asset crypto wallets prioritizing design and ease of use.

With self-custodial wallets, Exodus puts customers in full control of their funds, enabling them to swap, buy, and sell crypto. Its business solutions include Passkeys Wallet and XO Swap, industry-leading tools for embedded crypto wallets and swap aggregation.

Exodus is committed to driving the future of accessible and secure finance. Learn more at www.exodus.com or follow us on X at www.x.com/exodus_io.

Disclosure Information

Exodus uses the following as means of disclosing material nonpublic information and for complying with disclosure obligations under Regulation FD: websites exodus.com/investors and exodus.com/blog; press releases; public videos, calls and webcasts; and social media: Twitter (@exodus_io and JP Richardson's feed @jprichardson), Facebook, LinkedIn, and YouTube.

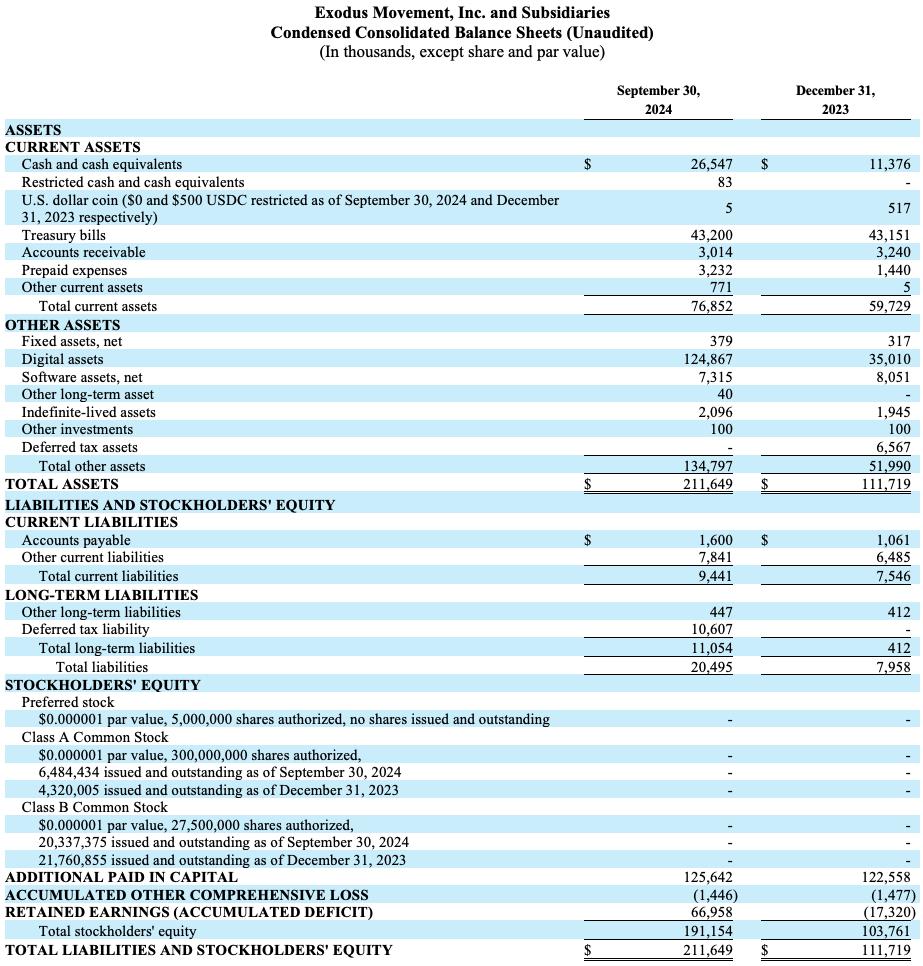

3

4

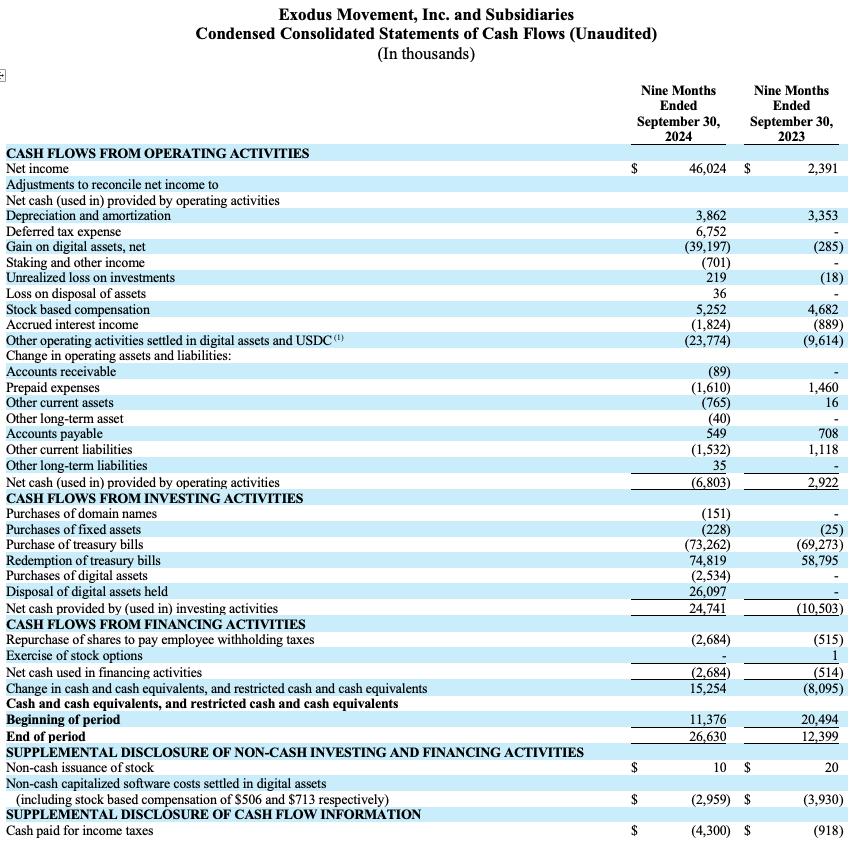

5

Forward-Looking Statements

This press release contains “forward-looking statements” as that term is defined by the federal securities laws. All forward-looking statements are based upon our current expectations and various assumptions and apply only as of the date made. Our expectations, beliefs, and projections are expressed in good faith, and we believe there is a reasonable basis for them. However, there can be no assurance that our expectations, beliefs and projections will be achieved. Forward-looking statements are generally identified by the words “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” “forecast,” as well as variations of such words or similar

6

expressions. Forward-looking statements in this document include, but are not limited to, quotations from management regarding confidence in our products, services, business trajectory and plans, and certain business metrics.

Forward-looking statements include statements concerning:

There are a number of risks, uncertainties and other important factors that could cause our actual results to differ materially from those expressed or implied by our forward-looking statements, including those set forth in “Item 1. Business” and “Item 1A. Risk Factors” of Amendment No. 4 to our Registration Statement on Form 10 filed with the Securities and Exchange Commission (the “SEC”) on October 10, 2024 (the “Form 10"), as well as in our other reports filed with the SEC from time to time. All forward-looking statements are expressly qualified in their entirety by such cautionary statements. Readers are cautioned not to place undue reliance on such forward-looking statements. Except as required by law, we undertake no obligation to update or revise any forward-looking statements that have been made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events.

7